Everything You Need to Know About Federal Tax Incentives For Electric Cars

Federal tax incentives for electric cars are designed to promote the adoption of environmentally friendly vehicles. These incentives encourage consumers to make the switch from traditional gasoline-powered vehicles to electric vehicles (EVs). Understanding these incentives is crucial for potential EV buyers, as they can significantly reduce the overall cost of purchasing an electric vehicle. In this article, we will explore everything you need to know about federal tax incentives for electric cars, including how they work, eligibility requirements, recent changes, and more.

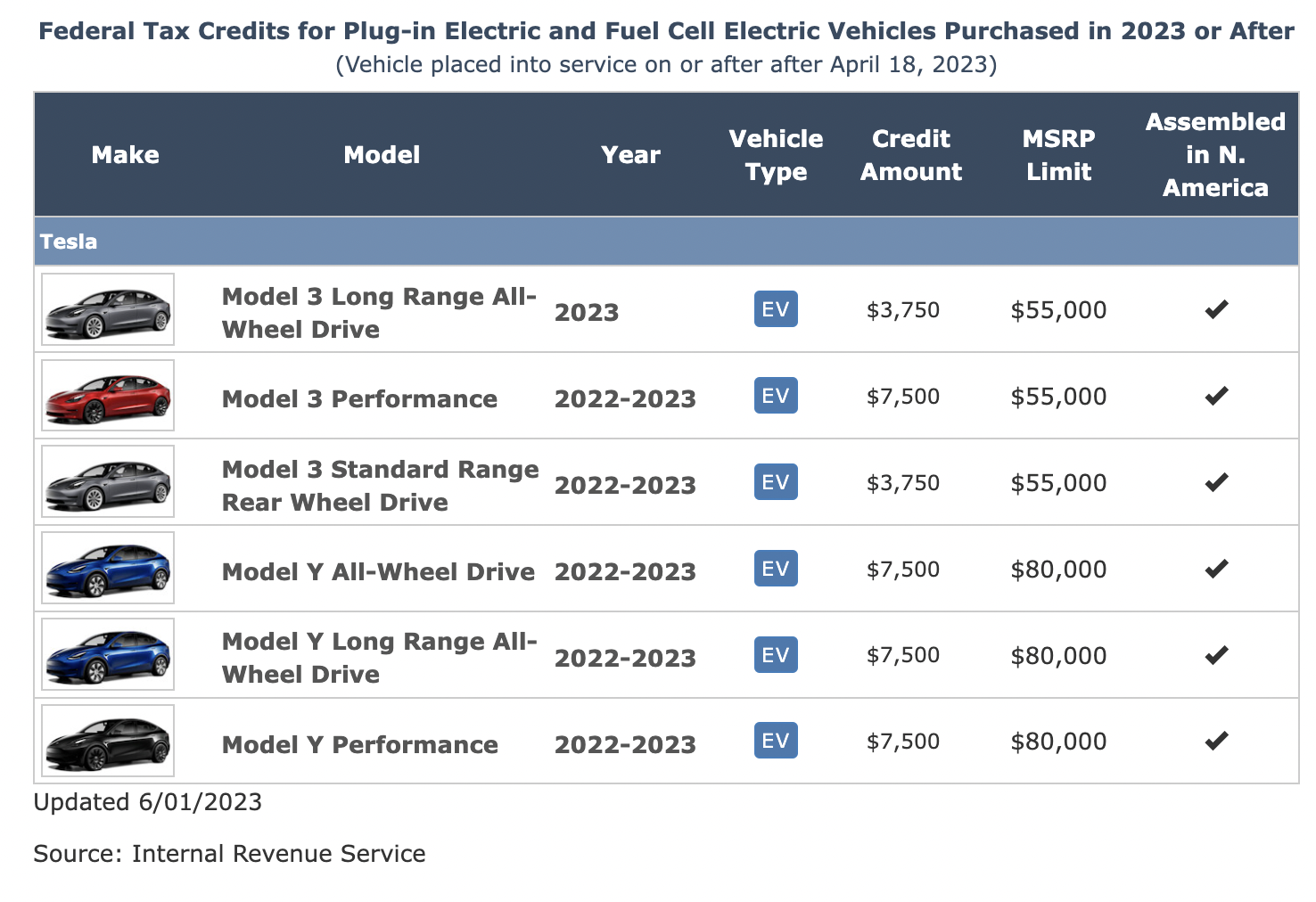

According to the Internal Revenue Service (IRS), buyers of qualified electric vehicles may receive up to $7,500 in federal tax credits.

Introduction

As interest in electric vehicles continues to grow, so does the importance of understanding the financial benefits associated with their purchase. The federal government has recognized the need to incentivize eco-friendly transportation solutions, offering various tax credits and rebates to motivate consumers to invest in electric vehicles.

With numerous changes in legislation, it’s essential for potential buyers to stay informed on the latest updates regarding federal tax incentives for electric cars. Not only do these incentives help meet environmental goals, but they also facilitate a smoother transition towards sustainable energy sources. Understanding the impact of federal tax incentives can enhance your EV purchasing experience and help you maximize savings while contributing to a greener future.

Why Federal Tax Incentives Matter for EV Buyers – federal tax incentives for electric cars

Federal tax incentives play a significant role in reducing the initial cost of electric vehicles. Many consumers may hesitate to adopt EV technology due to the perceived high price tag compared to traditional combustion engine vehicles. By providing tax credits that can offset some of the purchase price, the federal government makes electric vehicles more accessible to a broader audience.

In addition to lowering costs, these incentives address concerns related to range anxiety and charging infrastructure. As more consumers enter the EV market, it encourages manufacturers to invest in better technologies, thereby enhancing battery efficiency and expanding charging networks. This creates a positive feedback loop where increased demand for electric vehicles leads to further advancements in technology and infrastructure.

Finally, embracing federal tax incentives aligns with national efforts towards reducing greenhouse gas emissions and achieving climate goals. Buying an electric vehicle contributes directly to lowering your carbon footprint, which not only benefits the environment but also promotes energy independence. In essence, federal tax incentives for electric cars serve as a catalyst for change in both consumer behavior and industry practices.

Overview of the Federal EV Tax Credit Program

The Federal Electric Vehicle (EV) Tax Credit program was established to provide financial assistance to individuals who purchase qualified electric vehicles. Initially implemented under the Energy Policy Act of 2005, the program has evolved over the years to adapt to new technologies and market demands.

At its core, the federal tax credit allows eligible taxpayers to receive a credit against their federal income tax liability when they buy a qualified EV. This tax credit can range from $2,500 to $7,500 per vehicle, depending on the battery capacity and other factors.

While the program aims to spur EV adoption, it also includes specific criteria that must be met for buyers to qualify. Understanding these rules is vital for potential buyers looking to take advantage of the available financial incentives.

How the Federal EV Tax Credit Works

The federal EV tax credit is not applicable to all electric vehicles indiscriminately; rather, it depends on several key factors that determine eligibility and the amount of credit you can claim. Here, we’ll explore how this credit works in detail.

Eligibility Requirements for EV Owners

To qualify for the federal EV tax credit, the vehicle must meet specific criteria set forth by the IRS:

- Vehicle Type: The credit applies to fully electric vehicles, plug-in hybrid electric vehicles (PHEVs), and certain fuel cell electric vehicles (FCEVs).

- Purchase Date: Your vehicle must have been purchased new and cannot be used or leased from a previous owner.

- Battery Capacity: The vehicle’s battery must have at least 4 kWh of capacity to qualify for any credit. The higher the battery capacity, the larger the credit amount you might receive.

- Manufacturer Limitations: Once a manufacturer sells 200,000 qualifying electric vehicles, the tax credit begins to phase out for purchasers of their vehicles. However, this issue is being addressed with the new rules under the Inflation Reduction Act.

Since these criteria can vary, it’s important for potential buyers to double-check eligibility with the IRS or consult a tax professional before making a purchase.

Credit Amount: How Much Can You Get?

The amount of federal tax credit you can claim depends largely on the electric vehicle’s battery capacity. Generally, the credit works as follows:

- A base credit of $2,500 is available for vehicles with a battery capacity of at least 4 kWh.

- For every additional kWh above 5 kWh, you can add another $417 to the credit, up to a maximum of $7,500.

This means that if you’re considering a vehicle with a 10 kWh battery, you could potentially qualify for the full $7,500 credit. However, it’s crucial to note that the actual amount of credit you can claim will depend on your total tax liability for that year. If your liability is lower than the credit, you won’t receive the difference as a refund.

Vehicle Qualification Criteria

Not all electric vehicles are created equal, and not every EV qualifies for the federal tax credit. It’s essential to conduct thorough research based on the following criteria:

- Make and Model: Some manufacturers may have reached the sales threshold for the tax credit phase-out, eliminating the credit benefit for that particular model.

- Certification: The vehicle must be certified by the EPA as an electric or hydrogen fuel cell vehicle to be eligible for the tax credit.

- Date of Purchase: Always check the purchase date, as the laws surrounding tax credits can change frequently. Newer models typically feature the most updated compliance information.

Income Limits and Other Restrictions

In addition to vehicle-specific qualifications, there are income limits and restrictions that could affect your eligibility for the federal EV tax credit. As of 2024, there will be adjustments to income thresholds that align with the Inflation Reduction Act.

Depending on your filing status—single, married, etc.—your modified adjusted gross income (MAGI) must fall within specific categories to be eligible for the full or partial tax credit. Potential buyers should always verify whether they meet these income requirements before proceeding with a vehicle purchase.

Additionally, other restrictions may apply, such as those pertaining to leasing versus buying. It’s advisable to review IRS guidelines or consult with tax professionals for the most accurate and up-to-date information.

Changes in the EV Tax Credit (as of 2024–2025)

The EV tax credit landscape is dynamic, with policies changing regularly to reflect evolving priorities within the federal government. As of 2024-2025, several notable changes have occurred that could influence prospective buyers’ decisions.

New Rules Under the Inflation Reduction Act

The Inflation Reduction Act introduced substantial changes to the federal EV tax credit program aimed at boosting domestic manufacturing and promoting clean energy. One of the primary focuses is to encourage consumers to purchase vehicles produced in North America—a shift from previous guidelines which did not prioritize geographical origin.

Under the new rules, eligible EVs are likely to include those made by manufacturers who comply with strict labor and environmental standards. As a result, prospective buyers may see changes in the list of qualifying vehicles based on their place of manufacture.

Critical Mineral and Battery Component Requirements

Another significant aspect of the Inflation Reduction Act involves critical mineral and battery component requirements. To qualify for the federal tax incentive, a certain percentage of the battery components must be sourced from either the United States or free trade partners.

This requirement aims to boost domestic mining operations and decrease reliance on foreign supply chains, thereby strengthening the American economy. As a result, consumers may need to consider not just the brand and model of the EV but also the sourcing of materials used in its production.

Impact on Foreign-Made and Used Electric Vehicles

The new regulations also impact foreign-made and used electric vehicles. While previously, many foreign-manufactured EVs were eligible for the tax credit, tighter restrictions now require that vehicles must be manufactured domestically or meet specific sourcing criteria to qualify.

For used EVs, the introduction of a separate tax credit aimed at pre-owned electric vehicles signals a commitment to promote affordability across various price points. Yet, similar conditions on sourcing and manufacturing may apply here as well. With these changes, it’s essential for buyers to perform due diligence on the provenance of any vehicle they wish to purchase.

Step-by-Step: How to Claim the EV Tax Credit

Claiming the federal EV tax credit can seem daunting, especially if you’re navigating the process for the first time. However, following a step-by-step approach can simplify the procedure and ensure you don’t miss out on valuable savings.

Documentation You Need

Before you can claim the tax credit, you’ll need to gather specific documentation to validate your eligibility. Essential documents include:

- Purchase Agreement: A copy of the signed purchase agreement for the vehicle, including the VIN (Vehicle Identification Number).

- Proof of Payment: Receipts or bank statements showing proof of payment for the vehicle.

- Manufacturer Certification: Ensure that the manufacturer provides a certification confirming the vehicle meets all necessary qualifications for the tax credit.

Keep these documents organized and easily accessible, as you’ll need them when you file your taxes.

IRS Forms and Where to File

Once you’ve collected the necessary documentation, you’ll need to fill out the appropriate IRS forms to claim the credit. You’ll typically use Form 8834, the Qualified Plug-in Electric Drive Motor Vehicle Credit form.

Attach this form to your federal income tax return, whether you’re filing electronically or via mail. Be sure to double-check the current year’s instructions on the IRS website to ensure you complete the forms correctly and submit them to the right location.

When Will You Receive the Credit?

After you’ve submitted your tax return along with the completed forms, the timeline for receiving the credit can vary based on how you filed.

If you filed electronically and opted for direct deposit, you could expect to see your refund—including the EV tax credit—within a few weeks. However, paper filings may take considerably longer—up to several months—due to processing times. Patience is key, but once processed, you will see your credit reflected on your tax return.

Which Electric Vehicles Qualify?

The variety of electric vehicles on the market is continually growing, but not every model will qualify for the federal tax incentive. Knowing which vehicles meet the federal requirements is vital for potential buyers.

Full List of EVs That Meet Federal Requirements

The list of qualifying electric vehicles is subject to change annually, influenced by various factors including manufacturer compliance with federal standards and the evolving market. To remain informed, keep an eye on the IRS website, which provides an updated list of eligible EVs.

These lists typically feature models from major automakers such as Tesla, Ford, Chevrolet, and Nissan, among others. However, it’s essential to verify eligibility directly from the manufacturer as specifications and credits can shift after policy changes.

Plug-in Hybrids vs. Fully Electric: What’s Eligible?

When exploring options, buyers should distinguish between fully electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Both types may qualify for the federal tax credit, though the amount may differ.

Fully electric vehicles typically offer higher credits due to their larger battery capacities, while PHEVs may qualify for lower amounts based on their smaller batteries. Understanding the distinctions between these two categories helps buyers assess which vehicle type best fits their needs and budget.

Used EV Tax Credit Explained

The concept of a used EV tax credit reflects a growing recognition that not everyone can afford a brand-new vehicle. To promote the purchase of used electric vehicles, the federal government has instituted a separate credit program for eligible pre-owned EVs.

The used EV tax credit allows buyers to claim a credit of up to $4,000, provided they meet specific income thresholds and the vehicle meets the necessary qualification requirements. This initiative aims to expand access to electric vehicles and make them more affordable for a wider demographic.

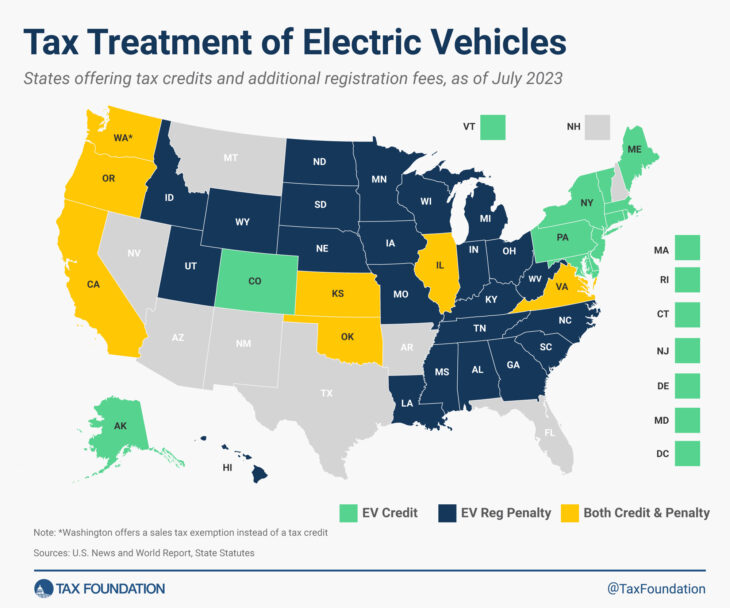

Combining Federal with State and Local Incentives

One of the most appealing aspects of purchasing an electric vehicle today is the ability to combine federal tax credits with state and local incentives. This layering of benefits can create substantial savings for buyers.

How to Stack Credits and Maximize Savings

Many states, municipalities, and utility companies offer their own incentives to promote electric vehicle adoption. These incentives can come in various forms, such as rebates, tax credits, and grants that enable buyers to save even more.

To maximize your savings, take the time to research available state and local incentives that complement the federal tax credit. Make a comprehensive list of what you might be eligible for, ensuring that you consider factors like vehicle type, income limits, and geographic requirements.

Examples from High-Incentive States

Certain states, known for their aggressive promotion of electric vehicles, offer substantial incentives that can amplify federal tax credits. For instance, California boasts a robust program that includes rebates, HOV lane access, and reduced registration fees for EV owners. Similarly, Colorado provides sizable state tax credits alongside federal incentives.

Researching high-incentive states can yield valuable insights into maximizing potential savings. Consult state energy offices or local utility providers for detailed information on what programs are currently available.

Common Questions and Misconceptions

When it comes to federal tax incentives for electric cars, misconceptions abound. Addressing common questions can help clarify the confusion surrounding these incentives.

Will I Still Get the Credit if I Lease an EV?

Many people wonder if the federal tax credit is available for leased electric vehicles. The good news is that lessees can also benefit from tax incentives!

However, the credit is often passed down from the manufacturer to the leasing company, which then factors it into the lease terms. Therefore, while you may not receive the credit directly, it can still reduce your monthly payments.

Is the Tax Credit Refundable or Nonrefundable?

It’s crucial to understand that the federal EV tax credit is nonrefundable. This means that if your tax liability is less than the amount of the credit, you will not receive the difference as a refund.

For example, if you qualify for a $7,500 credit but only owe $5,000 in taxes, you won’t get the remaining $2,500 returned to you. Instead, you would only receive a credit of $5,000, effectively lowering your tax bill.

What Happens if I Sell the EV Early?

Individuals concerned about the fate of their federal tax credit if they choose to sell their electric vehicle early need to understand the implications. Generally, selling your EV doesn’t automatically invalidate the credit you received. However, it’s essential to keep in mind that if the vehicle no longer serves its intended purpose as an electric vehicle—as outlined in the original credit agreement—you may be subject to penalties or complications during tax filing.

Consult with a tax advisor to clarify specifics regarding your situation and to ensure compliance with IRS guidelines.

Video

Conclusion

As the landscape surrounding electric vehicles evolves, staying informed about federal tax incentives becomes increasingly vital for potential buyers. By understanding how the federal tax credit works, eligibility requirements, and recent changes, you can make informed decisions about your EV purchase.

In 2025, the availability of federal tax incentives for electric cars–along with state and local programs–will continue to play a significant role in promoting electric vehicle adoption. With the ongoing push towards a greener future, there has never been a better time to invest in electric vehicles and reap the benefits of available savings.

In summary, whether you are a seasoned EV enthusiast or a first-time buyer, leveraging federal tax incentives can make owning an electric vehicle more financially feasible. Stay vigilant about updates, educate yourself on the specifics, and embark on your journey toward a cleaner, more sustainable automotive experience.