Maximize Your Savings with EV Tax Rebates

The ev tax rebate offers a valuable opportunity for consumers looking to invest in electric vehicles (EVs). As the world shifts towards eco-friendly alternatives, incentivizing EV purchases becomes crucial to facilitate this transition. Understanding how these rebates work allows individuals to maximize their savings while contributing to a more sustainable future.

What Is an EV Tax Rebate?

To understand the value of an ev tax rebate, we must first define what it is and how it operates within the broader scope of tax incentives.

Definition and How It Differs from a Tax Credit

An EV tax rebate is a financial incentive provided by government entities to encourage consumers to purchase electric vehicles. This rebate typically comes in the form of a refund on taxes owed, effectively lowering the overall cost of the vehicle.

While often used interchangeably, it’s essential to differentiate between a rebate and a tax credit. A tax credit directly reduces the amount of tax owed dollar-for-dollar, whereas a rebate can be seen as a refund after the purchase or as a reduction in total vehicle price at the point of sale. The implications of this difference can significantly affect an individual’s finances depending on their unique tax situation.

Who Offers EV Tax Rebates?

Understanding who provides these incentives helps clarify the landscape of available financial support for potential EV buyers.

Federal programs are typically the most widely recognized. The federal government has established various tax credits for electric vehicles aimed at reducing greenhouse gas emissions and providing a boost to the EV market. However, state programs have gained prominence in recent years, often offering even more generous rebates than those provided federally.

States like California and New York have implemented robust rebate programs that complement federal offerings. It’s worth investigating both levels of incentives since they can vary significantly in terms of benefits and eligibility criteria.

How EV Tax Rebates Can Help You Save

Embracing electric vehicles not only helps the environment but also presents numerous financial advantages through ev tax rebates.

Direct Savings After Purchase

One of the most attractive aspects of EV tax rebates is the direct savings realized immediately after the purchase. When buying an electric vehicle, buyers can sometimes receive their rebate at the point of sale. This means that rather than waiting until tax season to apply for a credit, they can see reduced costs upfront, making the car more affordable from the outset.

This immediate financial relief can be a game-changer for many consumers. It allows them to allocate funds elsewhere—whether toward additional vehicle accessories, home charging equipment, or simply into their savings accounts—effectively stretching their budget further.

Potential for Additional State and Utility Incentives

Beyond federal subsidies, many states and local utility companies offer additional incentives, which can stack on top of the federal rebates.

For instance, some states provide extra rebates for low-income households, ensuring that all communities can benefit from the shift towards electric mobility. Additionally, some utility companies may offer cash rebates for installing home charging stations or discounts on electricity rates for EV owners.

These combined incentives can lead to significant savings over time. In some cases, the cumulative effect of federal, state, and utility rebates can substantially lower the overall cost of owning an EV, making it an economically viable alternative to traditional gasoline vehicles.

Real Examples of Rebate Savings by Location

Across the country, several localized programs demonstrate how rebates can differ based on geographic location. For example, California offers one of the most comprehensive programs through the Clean Vehicle Rebate Project (CVRP), which provides incentives between $2,000 to $7,000 based on income levels for qualifying EVs.

Similarly, Colorado offers a state tax credit up to $5,000, along with additional municipal level incentives. Awareness of specific programs in your area can lead to greater savings. Many consumers have successfully combined various rebates, resulting in substantial reductions in their vehicle costs.

Eligibility for EV Tax Rebates

Before diving headfirst into the world of electric vehicles, understanding eligibility requirements for ev tax rebates is crucial.

Income Requirements and Filing Status

Eligibility for various EV tax rebates often hinges on income requirements and filing status, particularly concerning state-sponsored programs. Federal rebates typically do not have strict income limits, allowing a broad range of consumers to benefit.

However, certain state programs have instituted caps based on income to ensure that rebates primarily assist low-to-middle-income families. For those interested in these programs, it is essential to check the specifics regarding income thresholds and assess personal eligibility.

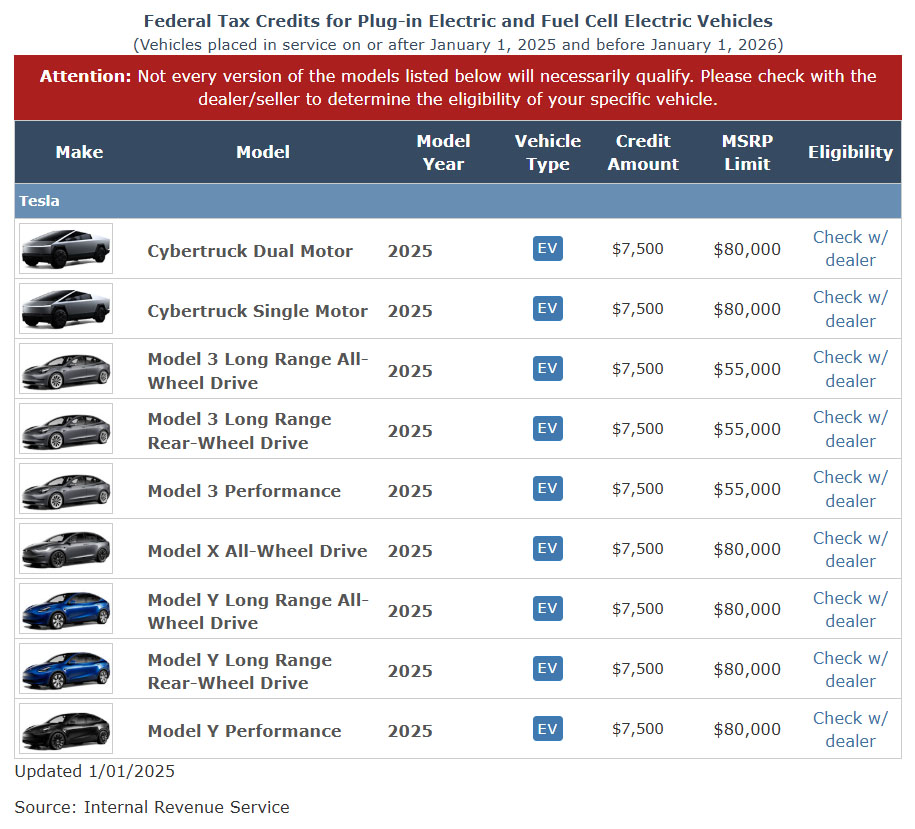

Vehicle Requirements and Approved Models

Not every electric vehicle qualifies for tax rebates. Generally, only models that meet stringent emission standards and battery capacity requirements will be eligible.

Vehicle manufacturers often provide information regarding which of their models qualify for the rebate and any associated details regarding the application process. Prospective EV buyers should pay careful attention to these specifications to avoid purchasing a model that ultimately doesn’t qualify for any incentives.

Does Leasing Still Qualify?

A common misconception is that leasing an EV disqualifies buyers from receiving rebates. In reality, many states extend rebates even to leased vehicles. The key is understanding how the rebate works in conjunction with leasing agreements.

In some cases, the manufacturer or dealer might apply the rebate directly to the lease payments, thus reducing monthly costs. Understanding the nuances of how leasing interacts with available rebates will enable consumers to make informed decisions that optimize their savings.

Where to Find the Best EV Tax Rebates in the U.S.

Finding the best EV tax rebates involves diligent research and familiarity with regional programs across the United States.

Top States Offering High Rebates

Some states stand out when it comes to offering significant rebates for electric vehicle purchases.

California remains a leader due to its progressive policies aimed at promoting clean energy. Alongside California, New York and Colorado have developed attractive programs targeting prospective EV buyers, with incentives designed to promote environmental sustainability while easing the financial burden of purchasing a new vehicle.

Researching each state’s rebate program can yield valuable insights into where you may find the best deals on electric vehicles. For instance, knowing that certain states allow for greater rebate amounts might influence your decision about where to reside or shop for a vehicle.

How to Search for Local Incentives and Utility Rebates

Utilizing online resources can simplify the search for local incentives and utility rebates. Many websites aggregate information on state-specific programs, making it easy to compare offerings across different regions.

Additionally, contacting local dealerships can provide insight into manufacturer incentives that may not be well-publicized. Dealerships often have updated information on both state and federal incentives, plus they can guide you through the application process, ensuring you don’t miss out on any potential savings.

How to Apply for an EV Tax Rebate

Navigating the application process for an ev tax rebate can be overwhelming, but understanding the necessary steps can aid in streamlining this experience.

Required Documents and Application Process

Typically, applying for an EV tax rebate requires a few essential documents. Buyers will need proof of vehicle purchase, such as a sales receipt, along with documentation confirming eligibility, like income verification for state programs.

Each state and federal program may have slightly different requirements, so it’s vital to familiarize yourself with the specific documentation needed beforehand. Failure to supply the correct paperwork can delay the rebate approval process and may even result in denial.

Timeline for Receiving Your Rebate

The timeline for receiving an EV tax rebate varies significantly based on whether the rebate is applied at the point of sale or during tax filing.

If the refund occurs at the point of sale, consumers can enjoy immediate savings, whereas filing for a tax credit can take weeks or even months. Understanding these timelines can help buyers manage their expectations and plan accordingly.

Mistakes to Avoid During the Application

Avoiding common mistakes during the application process can save time and stress. One frequent error includes failing to read the fine print regarding eligibility requirements, leading to unexpected disqualifications.

Additionally, miscalculations in the documentation or missing deadlines can also hinder the rebate process. Ensuring that all necessary forms are completed accurately and submitted on time is essential for a smooth application experience.

Combining EV Rebates with Other Incentives

Maximizing your savings often involves combining various incentives, making it essential to know how to stack rebates and tax credits effectively.

Can You Stack Rebates and Tax Credits?

Yes, many consumers may combine several types of rebates and tax credits to enhance their savings when purchasing an EV.

For example, taking advantage of both federal tax credits and state rebates can lead to substantial financial relief. However, being aware of limitations, such as “stacking” only certain types of incentives, is important to ensure compliance with the rules governing these programs.

EV Manufacturer Promotions and Dealer Discounts

Manufacturers may frequently offer promotions and discounts that can complement existing tax rebates.

Negotiating with dealers can yield additional savings, especially for electric vehicles that are already subsidized. Some manufacturers run seasonal promotions that enhance the value proposition for buyers, making it worthwhile to stay informed on the latest opportunities.

Frequently Asked Questions About EV Tax Rebates

As the interest in electric vehicles grows, so does the number of questions surrounding ev tax rebates. Let’s look at some frequently asked questions.

Do I Get the Rebate at the Time of Purchase?

Whether or not you receive your rebate at the time of purchase generally depends on the specific program you are utilizing.

Many states allow for immediate rebates at the point of sale, but others may require consumers to apply post-purchase. Familiarizing yourself with the process in advance can help you better understand when to expect savings.

What If I Buy a Used EV?

Buying a used electric vehicle can complicate rebate eligibility.

While some programs offer incentives for used EVs, many of the federal and state rebates are aimed solely at new vehicle purchases. Always double-check the stipulations on used car purchases to determine if you can receive any financial aid for your investment.

Is There a Rebate for Installing a Home Charger?

Yes, numerous programs exist that offer rebates for installing home charging stations.

Given that charging infrastructure is critical for successful EV adoption, governments are increasingly incentivizing homeowners to install chargers. This addition not only enhances convenience but may also provide further savings through rebates, helping consumers maximize their overall investment in electric vehicles.

Video

Conclusion

Are EV Tax Rebates Worth It in 2025?

Looking ahead into the future of electric vehicles and their associated savings, ev tax rebates will likely continue to play a crucial role in enticing consumers to make the switch to electric.

As policies evolve and technology advances, the financial landscape surrounding electric vehicles will only become more favorable for the average consumer. Evaluating the potential long-term savings and environmental benefits reinforces the notion that investing in EVs remains a wise choice.

Final Tips to Maximize Your EV Purchase Savings

Ultimately, becoming an informed consumer is the best way to capitalize on savings from ev tax rebates. Researching available options, understanding eligibility, and maintaining awareness of local programs can greatly enhance your experience.

Combining incentives and negotiating with dealers can create a more advantageous purchasing environment, allowing you to drive away with a sense of satisfaction and financial relief. Embrace the journey towards sustainability and maximize your savings today!

You can read: Everything You Need to Know About Electric Vehicle Credit