Complete Guide to Federal EV Charger Tax Credits for Homeowners

As electric vehicles (EVs) gain popularity, many homeowners are considering installing charging stations at home. One significant financial incentive for this transition is the federal EV charger tax credit. This tax credit can help offset the costs associated with purchasing and installing a home EV charger, making it an attractive option for those looking to invest in renewable energy and reduce their carbon footprint.

Introduction

Electric vehicles offer numerous benefits, including reduced emissions, lower fuel costs, and government incentives. With the growing emphasis on sustainability, many homeowners are now recognizing the importance of having their own EV chargers. The federal government supports this shift through various programs, including the federal EV charger tax credit, which incentivizes the installation of these chargers.

Why Home EV Chargers Are Becoming Essential

The rise in electric vehicle ownership has brought forth a pressing need for adequate charging infrastructure. Home EV chargers provide convenience, allowing homeowners to charge their vehicles overnight without needing to visit public charging stations.

Convenience Comes First

Having a home charger significantly enhances the overall experience of owning an electric vehicle. Instead of relying on public charging stations that may not always be available or convenient, homeowners can plug in their cars when they return home from work or errands. This ease of use often translates to increased confidence in making the switch to electric.

Environmental Responsibility

In addition to convenience, transitioning to electric vehicles represents a step toward greater environmental responsibility. The reduction of greenhouse gas emissions from traditional gas-powered vehicles is crucial for combating climate change. By installing a home EV charger, homeowners make a commitment to cleaner energy and sustainable practices.

Financial Incentives

Beyond the personal and environmental benefits, there are also substantial financial incentives available. The federal EV charger tax credit allows homeowners to recoup part of the costs associated with purchasing and installing a charger. This government support makes the investment much more feasible for average Americans.

What Is the Federal EV Charger Tax Credit?

The federal EV charger tax credit is a government program designed to encourage the installation of electric vehicle charging stations in residential properties. It allows eligible homeowners to claim a percentage of their total installation costs as a tax credit when filing their annual taxes.

Definition and Scope

This tax credit specifically applies to the cost of equipment and installation of Level 2 EV chargers in residential settings. As the demand for electric vehicles continues to grow, so does the need for accessible charging solutions at home. This initiative aims to alleviate some of the upfront costs associated with installing such systems.

Importance of the Tax Credit

This tax credit serves multiple purposes: it promotes the adoption of electric vehicles, supports the economy by encouraging spending on green technologies, and contributes to achieving carbon reduction goals set out by various governmental bodies. Understanding how the credit works is key for homeowners looking to maximize their investment.

Understanding the Federal EV Charger Tax Credit

To fully benefit from the federal EV charger tax credit, it’s essential to understand what it covers and how it can benefit you as a homeowner.

What It Covers: Equipment and Installation Costs

The federal EV charger tax credit encompasses both the purchase price of the charging equipment and the costs associated with its installation.

Equipment Costs

Homeowners can claim the cost of the EV charger itself, which typically includes Level 2 charging units. These chargers generally range from $400 to $1,500 or more, depending on the brand and features.

Installation Costs

Installation expenses can be significant, especially if electrical upgrades or permits are required. The tax credit covers these costs as well, making it a comprehensive incentive for homeowners considering this setup. It’s advisable to consult with certified electricians to get accurate estimates for the entire installation process.

Claiming the Full Cost

It’s important to note that homeowners can claim up to 30% of the total cost (equipment plus installation) of the EV charger as a tax credit, subject to limits set by the IRS and legislation. Familiarizing yourself with these details can lead to substantial savings when filing your taxes.

How Much Can Homeowners Claim in 2025?

As tax credits are subject to change based on new legislation or policy adjustments, it’s vital for homeowners to stay updated on potential amounts they can claim.

Projected Credit Amounts

For tax year 2025, it’s expected that the maximum amount a homeowner can claim will be around $1,000 for residential installations, following historical trends and recent legislative initiatives aimed at promoting EV adoption.

Planning for Future Changes

Tax laws often evolve, particularly as more resources are allocated towards environmental initiatives. Homeowners should keep abreast of any changes to the federal EV charger tax credit to ensure they capitalize on available credits.

Importance of Staying Informed

Being informed about tax credit amounts can influence decisions regarding the timing of installation. Some may choose to delay their installation until a higher credit amount is available or take advantage of specific incentives tied to certain dates.

Key Differences Between EV Charger Credit and General EV Tax Credit

While both credits aim to promote electric vehicle usage, they function distinctly and cater to different aspects of the EV ecosystem.

Purpose and Application

The federal EV charger tax credit specifically addresses the installation of charging equipment, while the general EV tax credit applies to the purchase of electric vehicles themselves. Understanding these distinctions helps clarify eligibility and benefits for homeowners.

Eligibility Criteria

Eligibility criteria differ between the two credits. For instance, to qualify for the EV charger credit, the homeowner must have a designated place for installation and must utilize the charger primarily for personal use.

Financial Implications

Although both credits offer substantial savings, the monetary implications of each vary significantly. The EV purchase credit can reduce the overall cost of a vehicle substantially, while the charger credit provides a smaller but still meaningful offset for installation expenses.

Eligibility Requirements

Understanding the eligibility requirements for the federal EV charger tax credit is critical for homeowners looking to take advantage of this incentive.

Who Qualifies for the Credit?

The first step to claiming the tax credit is determining whether you meet the basic qualifications.

Homeownership Status

Primarily, the credit is available for homeowners who install an EV charger in their primary residence. Renters do not qualify, as the installation must occur on property that the taxpayer owns.

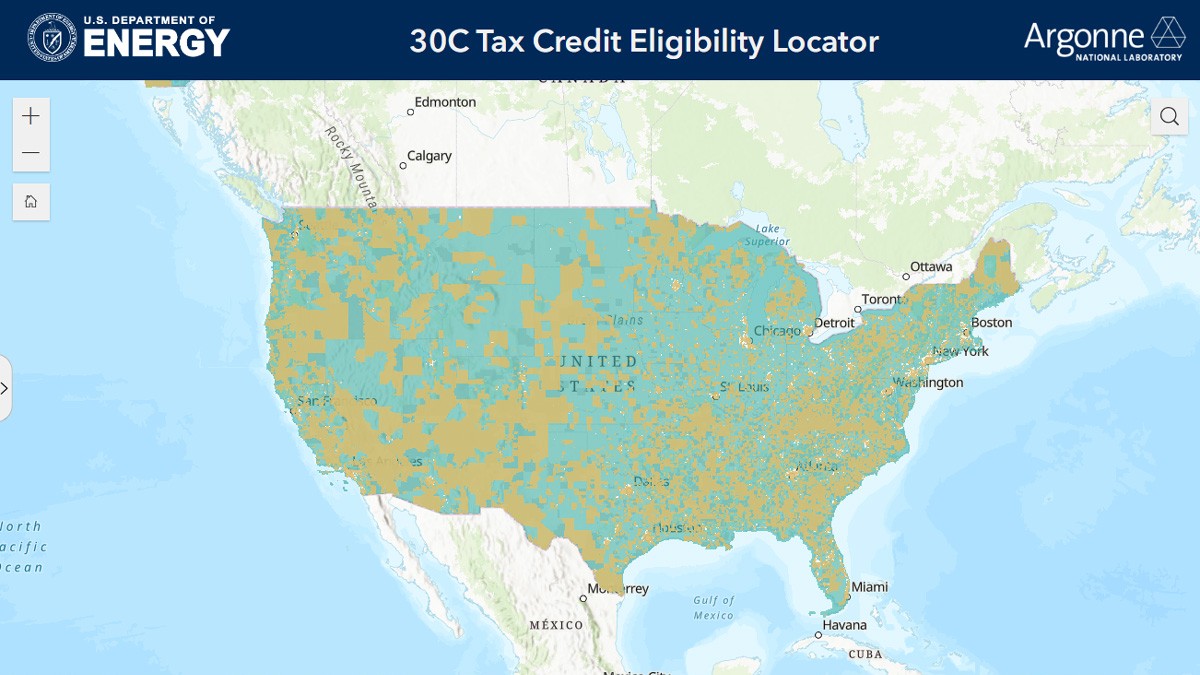

Location of Installation

The charger must be installed in the United States to be eligible for the tax credit. Homeowners should also ensure they adhere to all local codes and regulations when installing their charging stations.

Property Type: Homeowners vs. Renters

The distinction between homeowners and renters is crucial when it comes to eligibility for the federal EV charger tax credit.

Homeowners Have the Advantage

Homeowners have the unique advantage of being able to install the necessary equipment on their property without seeking permission from landlords or property managers. This autonomy can also lead to additional benefits like improving property value.

Renters’ Limitations

Renters may feel the burden of wanting to participate in the electric vehicle movement but face limitations on where they can install chargers. Some landlords may allow it; however, it often requires negotiations and added complexities.

Residential vs. Commercial Installation

Another important aspect of eligibility is the distinction between residential and commercial installations of EV chargers.

Residential Focus

The federal EV charger tax credit is tailored for residential setups, meaning it specifically pertains to private homes. Commercial installations are not eligible under this particular incentive.

Business Opportunities

Businesses looking to install EV charging stations should investigate other available incentives aimed at commercial installations. While they won’t qualify for the residential tax credit, many states and local governments offer distinct incentives for businesses adopting similar technology.

How to Claim the Federal EV Charger Tax Credit

Once you’ve confirmed your eligibility for the federal EV charger tax credit, the next step is understanding the claims process.

IRS Forms You’ll Need (e.g., Form 8911)

Filing for the credit involves utilizing specific IRS forms.

Identification of Forms

One of the main forms you’ll need is Form 8911, which is specifically designed for electric vehicle charging station credits. This form includes detailed sections requiring information about the installation and costs incurred.

Additional Documentation

Aside from Form 8911, you may also need to submit copies of receipts and invoices related to your charger installation. Ensure that your documentation is thorough to avoid complications during the filing process.

Required Documentation and Receipts

Keeping organized records is essential for successfully claiming the federal EV charger tax credit.

Types of Documents Needed

Homeowners should retain invoices, receipts, and contracts related to the purchase and installation of their EV chargers. Detailed records help substantiate claims and simplify the filing process.

Importance of Accuracy

Accurate documentation is crucial for navigating potential audits or inquiries from the IRS. Invest time upfront in organizing your paperwork to ensure everything aligns with your tax filings.

Timeline: When to File and When You’ll See the Credit

Understanding the timeline associated with claiming the credit can help alleviate uncertainties during tax season.

Filing Deadlines

Typically, homeowners will file their tax returns during the standard tax season, usually beginning in late January and ending on April 15. Ensure that you include Form 8911 along with your regular tax returns.

Receiving Your Credit

Once filed, the credit will reflect on your tax return, resulting in either a reduction of your tax liability or potentially a refund. Homeowners generally receive refunds within a few weeks, depending on how they file.

Installation Tips to Maximize Your Tax Savings

To fully leverage the federal EV charger tax credit, homeowners must navigate the installation process wisely.

Choosing a Qualifying EV Charger

Choosing the right EV charger is crucial, as not all chargers qualify for the credit.

Researching Options

Homeowners should explore Level 2 charging stations compatible with their electric vehicles. Seek options that are Energy Star-certified, as energy-efficient products could yield further benefits.

Consultation with Experts

Consulting with local installers can provide insight into which models are most suitable for your needs and eligible for tax credits. Utilize expert advice to streamline the selection process.

Hiring Certified Electricians

Professional installation is not just safer; it also ensures that the charger is compliant with local codes and regulations.

Importance of Certification

Hiring licensed electricians familiar with installing EV chargers guarantees adherence to safety standards. A certified professional can also point out additional considerations that may affect your overall experience.

Cost-Benefit Analysis

While hiring a professional may represent an upfront expense, the long-term benefits of proper installation outweighed the costs. Additionally, you should ensure the electrician provides receipts for their work, as these documents are needed for the tax credit application.

Bundling With Other Home Energy Upgrades

Combining the installation of a home EV charger with other energy-efficient upgrades can amplify savings and benefits.

Comprehensive Energy Audits

Consider having an energy audit conducted to identify other potential upgrades. Installing solar panels or energy-efficient appliances alongside your EV charger might qualify you for additional rebates and incentives.

Long-Term Savings

Investing in multiple improvements may save on energy bills while providing greater overall savings captured through various tax credits and rebates.

Combining With Other Incentives

The federal EV charger tax credit can often be combined with other incentives, enhancing the overall financial benefits for homeowners.

State-Level Rebates and Utility Incentives

Many states offer additional rebates or incentives for homeowners who install EV chargers or engage in other energy-saving practices.

Exploring Local Programs

Homeowners should research state-level programs, as these can differ significantly from one region to another. Some areas may offer direct cash rebates for the installation of charging stations or utility credits for using sustainable energy sources.

Engaging with Utility Providers

Contact local utility providers to inquire about incentives available through them. Many utilities are working to expand their infrastructure and may offer programs to promote clean energy usage.

Can You Combine This With the EV Purchase Tax Credit?

If you’re considering purchasing an electric vehicle simultaneously with installing a charger, it’s vital to know how these credits interact.

Dual Benefit Potential

Homeowners can indeed take advantage of both the EV purchase tax credit and the federal EV charger tax credit. However, it’s important to ensure that you meet the eligibility criteria for both credits, as they focus on different aspects of the EV ecosystem.

Maximizing Savings

Utilizing both credits together maximizes your savings during tax season, reinforcing the financial rationale for investing in EV technology. Calculate the potential savings before engaging in either purchase to make informed decisions.

Common Questions About the EV Charger Tax Credit

As homeowners consider taking advantage of the federal EV charger tax credit, several common questions may arise.

Does the Credit Roll Over if You Don’t Use It All?

Understanding how the credit functions can help mitigate concerns about unused portions.

Non-Refundable Nature

Generally, the federal EV charger tax credit is non-refundable, meaning you cannot carry over any unused portion to future tax years. Homeowners must ensure they qualify for the credit amount they’re claiming.

Can You Claim It for Multiple Properties?

Homeowners may wonder whether they can claim the credit for installations at multiple residences.

One Residence at a Time

The tax credit is limited to one primary residence per taxpayer per tax year. However, if you own multiple homes, you must decide where the installation would yield the greatest benefit.

What If You Installed a Charger Before 2023?

Clarifying eligibility for past installations is essential for homeowners who may have already invested in chargers.

Historical Credit Availability

The federal EV charger tax credit became more widely available starting in 2023, but previous installations may not qualify unless they were performed according to specific criteria set by earlier regulations. Homeowners should check IRS guidelines to determine eligibility.

Video

Conclusion

Final Thoughts on the Federal EV Charger Tax Credit

The federal EV charger tax credit offers a valuable opportunity for homeowners to offset costs associated with installing electric vehicle chargers at home. Understanding the nuances of this incentive can pave the way for significant savings and further environmental responsibilities.

Why Now Is the Right Time to Install a Home EV Charger

With government support emphasizing the importance of electric vehicles, now is an opportune time for homeowners to consider installing EV chargers. The financial incentives available today are likely to evolve, making it prudent to act sooner rather than later to maximize savings. Taking advantage of the federal EV charger tax credit is not just a financially sound decision; it’s also a proactive step toward a more sustainable future.

You can read: Everything You Need to Know About Federal Tax Incentives For Electric Cars